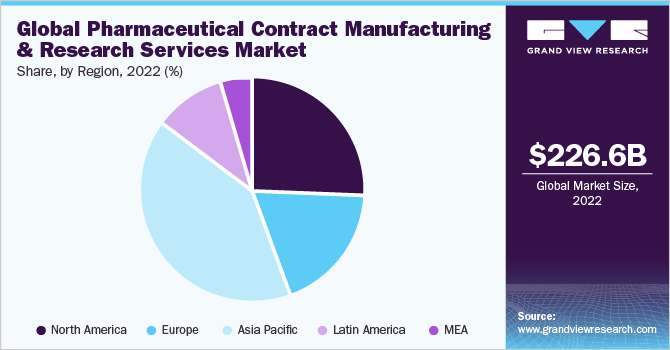

The global pharmaceutical contract manufacturing and research services market size was valued at USD 226.6 billion in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 7.10% from 2023 to 2030. Cost-saving and time-saving benefits associated with the implementation of outsourcing are responsible for driving the market. The market participants are routinely investing in infrastructure, personnel, and technology in order to gain a greater share of the outsourcing revenue. The presence of end-to-end service providers that are engaged in offering value-added services for an integrated or risk-sharing business model is expected to bolster growth in this industry. The COVID-19 pandemic during its advent had temporally affected the supply chain, which is likely to have a negative effect on the market growth.

Changing product portfolio is also responsible for the growth of the service-based market. “One-stop-shop” offered by the CMOs for the promotion of a portfolio of a complete range of products is anticipated to influence the growth of CMOs. The larger CMOs are embracing the trend of moving and focusing on the niche areas of pharmaceutical development. They are focusing on the establishment of regulatory pathways for transgenic-based product development. However, the companies are willing to restrict outsourcing for the manufacturing of complex and big moieties. They are in an opinion of in-house production rather than outsourcing owing to the specific requirements. This, in turn, may act as a challenge for the market.

The COVID-19 pandemic has generated high demand for therapeutics and vaccines owing to the rising spread of the diseases worldwide. Owing to this, several companies had partnered with CMO to speed up the manufacturing of drugs. For instance, in December 2020, a CDMO, Recipharm signed an agreement with a pharmaceutical company Moderna. As per the agreement, Recipharm supported the fill-finish part of the Moderna COVID-19 vaccine for supply to countries outside the U.S. Many public organizations have also provided funding to support the research of COVID-19 vaccines . For instance, as of February 2022, the U.K. government invested USD 119.1 million to support the development of the Oxford/AstraZeneca COVID-19 vaccine. This is expected to have a positive impact on market growth.

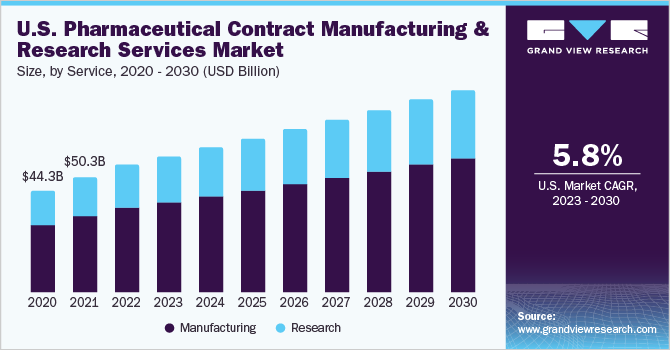

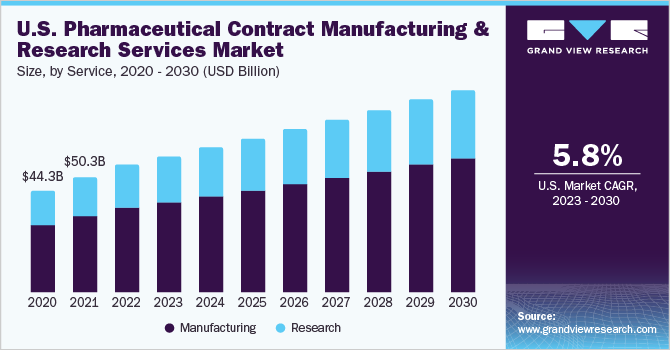

The manufacturing segment held the largest revenue share of over 66.2% in 2022. This segment is further segmented into API/bulk drugs manufacturing, advanced drug delivery formulations, packaging, and finished dose formulations. API dominated the market in 2021 as a consequence of the rising demand for High Potency Active Pharmaceutical Ingredients (HPAPI). Market entities are engaged in the development of large-scale manufacturing facilities on a pilot as well as commercial scale.

Finished dose formulations are anticipated to expand at the fastest CAGR of 7.6% over the forecast period. Among these, solid formulations accounted for the largest revenue share in 2022 due to the higher outsourcing done for the powdered formulations. It is expected to witness gradual expansion in the coming years as it represents a significant share of the outsourcing of finished dose formulations. Solid dose manufacturing and oral delivery of new drug candidates, fixed-dose combinations, controlled release dosage forms, and reformulation of existing drugs are some of the factors likely to accelerate the growth of contract manufacturing of solid dosage formulations.

Asia Pacific dominated the market with a revenue share of over 41.3% in 2022 and is projected to grow at a significant rate over the forecast period. This growth is supported by a rise in the number of companies outsourcing projects in the developing economies of this region. In recent years, countries such as Singapore, China, and India have been observed as major players in the pharmaceutical industry owing to their expanding manufacturing capabilities. The cash-rich nature of the Asian companies is responsible for the captive nature of the contract manufacturing sector. The spout of significant investments by Asian CMOs is expected to result in exponential progress.

The Latin American market is anticipated to witness substantial growth over the forecast period as a consequence of the presence of established multinational players in this region. Major entities operating in Brazil are Novartis, Roche, and Pfizer. Latin America holds the potential for transforming into a global hub for the development and production of pharmaceutical products. Factors that are responsible for this transformation include the low cost of product development.

Market players are focusing on agreements, partnerships, collaborations, acquisitions, and other strategies to strengthen their market position. For instance, in January 2021, Boehringer Ingelheim entered into a planned collaboration as well as licensing agreement with Enara Bio for research and advancements in novel targeted cancer immunotherapies using Enara Bio’s Dark Antigen discovery platform. Similarly, in February 2021, Charles River Laboratories International, Inc. announced that it has signed a contract to acquire Cognate BioServices, Inc., a cell and gene therapy CDMO, for around USD 875 million. Some prominent players in the global pharmaceutical contract manufacturing and research services market include:

Report Attribute

Details

Market size value in 2023